Table of Contents

Introduction to Auto Insurance and My Experience

In 1886 the first combustion automobile was invented. In 1897 the first auto insurance policy was issued. For both, there has been a tremendous amount of change over the last century and more.

When it comes to personal finance, no other area of insurance has as many ways to protect you or cause changes in your finances as auto insurance.

From 1993 to 1996 I worked for Progressive Insurance in their auto insurance division. I started as just quoting their insurance policies to insurance agents and direct customers, then later became a personal insurance policy representative, and finally an underwriter.

I believe that this tenure provides me with insights into how personal auto insurance work and what options there are for you to have a substantial impact on your finances through auto insurance policy changes.

State Requirements

All of the states in the U.S. have minimum levels of auto insurance that are required to legally operate an automobile. These minimum levels vary from state to state, along with what coverages are required also. These requirements are also susceptible to changes so please be aware of that as well.

Since I live in Texas, my examples will mostly pertain to here, but you can find a list of each of the states’ minimum auto insurance requirements here.

Several sections make up an auto insurance policy. Throughout the various states, some of them are required while in others some are not. Let’s go over the different sections and what they each protect against.

Liability

Liability coverage protects the other party (person(s) or property). There are two types of liability coverage: Bodily Injury and Property Damage.

Bodily injury covers some or all of the costs related to the other party’s injuries.

Property damage covers some or all of the costs related to the other party’s property, which can be a vehicle, but also can cover property such as a house, or a fence, or a tree, among others.

Uninsured and Underinsured

This type of coverage protects you if you are hit by a driver that does not have any insurance or by a driver that does not enough insurance to pay for all of the damages caused. Uninsured and Underinsured coverages may be used for either or both property or medical damages, depending on the state.

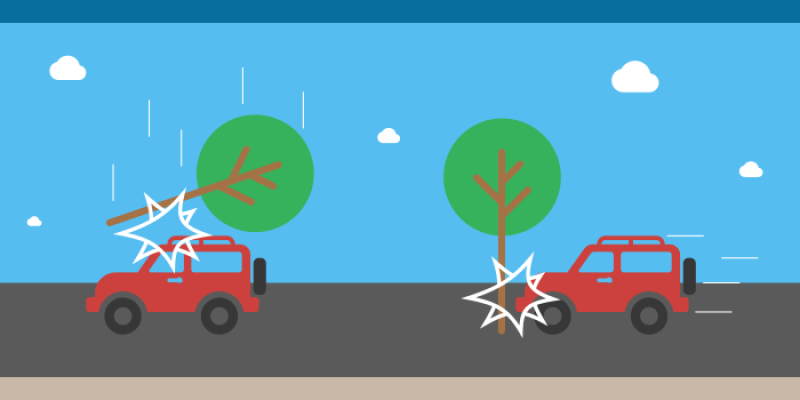

Comprehensive

Comprehensive coverage protects you against damages that are caused by “acts of God”, such as flood, fire, hail. It also protects against theft and vandalism. To receive the benefits of Comprehensive coverage, you must pay (meet) your deductible before the insurance takes over on any repairs.

Comprehensive coverage is not required by law, but it is usually required by a lienholder (lender) or leaseholder of the vehicle.

Collision

Collision coverage repairs your vehicle if you are in an accident with another vehicle and the accident is your fault. Collision coverage also protects you when you hit an object, such as a fence, building, or tree, etc. Like Comprehensive coverage, you must also pay (meet) your deductible before the insurance takes over on any repairs.

Collision coverage is not required by law, but it is usually required by a lienholder (lender) or leaseholder of the vehicle.

Medical

Medical coverage can pay towards the costs associated with the injury of you and/or your passengers who are injured in an accident involving your vehicle. The types of costs covered are hospital, surgery, ambulance, x-ray, and others.

Personal Injury Protection

Personal Injury Protection (PIP) is very much like medical coverage. In addition to helping cover the costs associated with the injury, PIP may also provide coverage on other expenses incurred as a result of the accident, such as lost income.

Additional Coverages and Add-Ons

In addition to the types of coverages already shown, many optional coverages and add-ons can be added to your insurance policy.

Emergency Roadside Assistance

This addition assists should you need a tow, run out of gas, lock yourself out of your car, or have a flat tire.

Rental Reimbursement

If you need a rental car while your’s is being repaired, this coverage will provide you reimbursement. The amount reimbursed is typically for basic transportation, not anything extravagant.

Gap Coverage

If your car is totaled (totaled means that the vehicle costs more to fix than what it is worth) by the insurance company and the payoff you receive is less than what is owed on the car, this insurance pays for the difference. It fills the “gap” between the amount owed and the payoff amount you received.

New Car Replacement

With the rate at which cars depreciate is quite possible that if your car is totaled while it is still relatively new, the price your receive from insurance will not be near the amount that you paid for the vehicle. This coverage protects against this possibility. In the event of a total loss, you will be paid the amount it would cost you to buy a new version of your car.

Windshield Coverage

While you can use Comprehensive coverage to repair or replace your windshield, the cost of the deductible is usually higher than the repair/replacement cost. With windshield coverage, the cost to repair or replace a windshield is waived.

Vanishing Deductibles

For each year that you are a safe driver and do not have any accidents or claims, the deductible is reduced by a set amount. For example, if your deductible is $500 and the reduction is $100 for each year, then if you have a claim after 3 years of safe driving your deductible would only be $200 instead of $500. Once you have a claim the deductible resets to what it initially was and you start over on the year after year safe driving.

Zero Depreciation

We all know that cars go down in value faster than almost any other item. If you own your car for several years it will be worth much less than what you, likely, initially paid for it or the cost to replace the vehicle. When you receive compensation for a vehicle that has been totaled, a standard insurance policy will take the depreciation cost of the vehicle into account when determining the payout. This can cause the payout to be much less than the replacement cost of the vehicle. With Zero Depreciation this determination is not used and you receive the total amount that the vehicle was valued at the time of assessment for the addition of Zero Depreciation to your auto insurance policy.

Accident Forgiveness

Typically when a driver on an insurance policy has an at-fault accident, the premiums on their insurance policy go up at renewal. With accident forgiveness, the insurance company does not penalize the renewal cost of the policy for the first at-fault accident on the policy. Additional at-fault accidents during the same policy term are not forgiven though and will likely cause an increase in premiums at renewal.

Not all drives are eligible for accident forgiveness either. See your specific insurance company about this add-on and its qualifications.

Engine Protection

Engine protection covers the cost of repairs of the engine, such as labor and/or parts. This covers the costs to repair wear-and-tear on the engine as well as repair from natural events, such as flooding.

Not all vehicles are eligible for engine protection coverage. Typically vehicles older than 5 years are not covered.

Discounts

Discounts available on auto insurance policies usually fall into three categories: safe driver, safe vehicle, and loyalty. Let’s look at each category in turn.

Safe Driver

Accident-Free Discount

If you go without an accident of any kind; your fault or not, for a set period, the premium of your policy will drop at renewal.

Defensive Driving Discount

If you take a defensive drive course you can earn up to 15% off your premiums. You may be able to take the course yearly, getting the discount each year as well.

Good Student

If you are between 16 and 25 years of age, and you keep your GPA at or above 3.0, then you can earn up to 25% off your premiums.

Safe Vehicle

Airbags, anti-lock brakes, anti-theft systems, and daytime running lights are all improvements to vehicles that cause them to be safer than vehicles without these features. As such you may qualify for discounts up to 25% for having any, some, or all of these features on your covered vehicle.

Loyalty

Multi-Vehicle

Multi-Vehicle discounts are applied when having 2 or more vehicles on the same policy.

Multi-Policy

Multi-Policy discounts are applied when you have multiple insurance types with the same carrier, such as auto and homeowners together. Each insurance policy will benefit from this discount, which can be as much as 15%.

Recommendations

Remember, insurance companies are not in the business of losing money. They have analysts and actuaries hard at work determining what to charge so that they will come out ahead in the event they have to payout to a customer. If you use the add-ons they still make money. If you never use the add-ons, they make even more money. It is a win-win for them, not you.

Are State Requirements Enough?

I live in Texas. Here the state requirements are 30/60/25 coverage, which translates to $30,000 injury coverage per person, $60,000 total injury coverage per accident, and $25,000 property damage coverage.

New cars can cost much more than $25,000 and a hospital visit with an ambulance ride can easily top $30,000 or $60,000. With this in mind, my wife and I have opted to increase our coverage to more realistic limits. We carry 100/300/100 coverage. The price difference between this and the minimum is not 3 times, but rather only about double. Insurance is there to protect you from life. Our additional premium is a small price for us to pay know we’re likely not going to be sued should we get into an auto accident for damages and injuries more than what state minimums can cover. We also keep these higher limits on our Uninsured and Underinsured coverages.

Vanishing Deductible

Sounds great, right. Read the fine print though. The additional cost for this may add up to more than $100 per year. Also, if you never have a claim, then you will continue to pay the higher premium without taking advantage of it. For example, if you don’t have a claim for 8 years and the additional premium cost for this add-on is $10 per month, the insurance company comes out way ahead. They knock $500 off your deductible and you’ve paid them an additional $960 for this. You may be better off putting the $10 per month into an Emergency Fund, then you’ll have your $500 deductible plus an additional $460.

Zero Depreciation

Like with the Vanishing Deductible, there is an additional premium for this add-on. It is a safe bet that if you saved the additional premium you could then cover the cost of depreciation and then some.

Check the cost vs. the benefit amount of all add-on coverages to see if you come out ahead over the term of the policy. In most cases, you will come out ahead by saving the price of the add-on in an Emergency Fund. You’ll be able to pay for whatever the add-on covers and have money left over.

Also, regularly get quotes from other carriers, especially at your renewal. You may be surprised to learn that you could get the same coverage for less with another carrier or more coverage for the same cost.

We get quotes each year and compare the premiums, with applicable discounts, to see what is best for our family. I’ve been using Everquote and Insurify for years to compare policies. I’ve also used independent agents, who can shop multiple carriers and who know the ins and outs of those carriers to get you pricing and discounts you may not be able to find on your own.

Conclusion and Summary

Now that you know about auto insurance, including the add-ons and discounts, I recommend that you regularly get quotes from other carriers, especially at your renewal. You may be surprised to learn that you could get the same coverage for less with another carrier or more coverage for the same cost.

We get quotes each year and compare the premiums, with applicable discounts, to see what is best for our family. I’ve been using Everquote and Insurify for years to compare policies. I’ve also used independent agents, who can shop multiple carriers and who know the ins and outs of those carriers to get you pricing and discounts you may not be able to find on your own.

Related Topics

For related information, please see my articles Savings: Why Is It Important? and Improve Cash Flow with Budgeting Tools and The Plan.

Together with every little thing that seems to be building within this specific area, many of your opinions are relatively exciting. On the other hand, I am sorry, because I can not subscribe to your whole plan, all be it exciting none the less. It looks to everyone that your commentary are actually not totally validated and in fact you are generally your self not totally convinced of the point. In any event I did take pleasure in examining it.

I know this if off topic but I’m looking into starting my own blog and was wondering

what all is needed to get set up? I’m assuming having a blog like yours would cost a pretty penny?

I’m not very internet smart so I’m not 100% positive.

Any tips or advice would be greatly appreciated.

Cheers

Go to YouTube and check out Neil Patel and Nate O’Brien. Also, check out Word Press blogs and videos. You will need a web hosting service, such as BlueHost. There will also be a lot of services you will be using, each with its own credentials (username/password); keep all that info secure with a password manager, such as NordPass. I learned on my own and am continuing to learn. Best of luck to you.

Kevin

A lot of what you articulate is supprisingly precise and it makes me ponder the reason why I had not looked at this with this light previously. This particular piece really did switch the light on for me as far as this specific issue goes. But there is actually just one position I am not necessarily too comfortable with so whilst I make an effort to reconcile that with the actual main theme of the position, allow me observe just what the rest of the visitors have to point out.Nicely done.