Table of Contents

What is Cash Flow?

Cash flow is your income less your expenses for a given period; usually measured over a month. Did you have enough income to cover all your expenses and still have money left over? If so, then you have a positive cash flow. If not, then you have a negative cash flow.

Positive cash flow can help you to achieve a great many things financially if you direct the extra money wisely and with intention. Negative cash flow means that you are living beyond your means and are likely going deeper into debt each month to keep your head above water. The different types of cashflow you experience can be decided by the use of budgeting tools and the plan.

Where is the Money Coming From?

To get a proper picture of your cash flow, you need to first identify where all income is coming from regularly. This is income that can be counted on to be coming in, month in, and month out. Bonuses, commissions, overtime, etc. are not to be counted on with rare exceptions.

Once you have all of your income identified, it is time to look at the other side of the cash flow coin, expenses.

Where is the Money Going?

The best way to know where your money is going is to track your expenses over a month or three, writing down every purchase.

It can be very eye-opening to learn that you are spending 10% of your take-home pay eating out. Maybe you can take lunch to work a few days a week to keep more of that money at home and improve cash flow.

The first time I ever did this was quite scary to see how much we were spending on beer. I’m not talking about a 12-pack or a case from the grocery store, but that tallboy that you pick up on the way home. Purchasing individual items when you can purchase multiples is always going to be more expensive. Once we were able to see this, we immediately saved money through better planning on our purchases.

You need to do this with every single expense to get the best picture. For your mortgage/rent and utilities, you can simply look at the past months’ bills to see those numbers. For almost everything else though, you need to track it somehow.

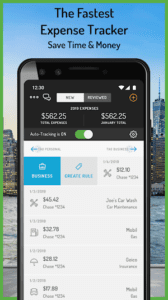

I use Hurdlr, shown here, which is a free app to track my expenses. This way it is always with me, making tracking easy.

To begin this, assume that everything that is not income is an expense.

The Dreaded B-Word

What is a Budget?

John Maxwell, author, speaker, and pastor, said, “A budget is telling your money where to go, instead of wondering where it went.”

The budget is the spending plan by which your cash flow is determined. It is the deliberate plan on how money is going to be spent or allocated as it comes into the household.

So often we get towards the end of the month and wonder where all our money went or worse, we do our taxes and are amazed at the income on the return while we feel we have nothing to show for it.

The foundation of being Financially Grounded is to have a working budget. This budget needs to be one that you and your partner (if applicable) both agree on. A budget should never be used to restrict anyone, but to create a guideline which to follow as money is brought into the home. With a budget you know where all incoming money is to be allocated. By following a budget you can get out of debt or keep yourself out of debt.

Budgeting Methods

There are many methods by which to structure a budget. Let’s examine some of the most popular ones. Once you understand how each works, you can decide which would work best for you. I’ll also let you know which we use in our family.

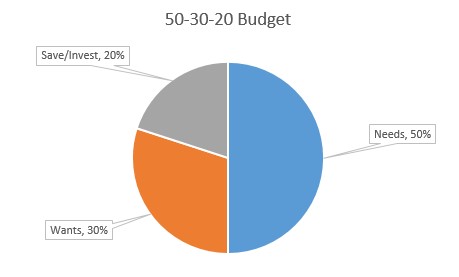

50-30-20 Method

The 50-30-20 Method is based on your after-tax income plus any pre-tax deductions. So if you have your 401k or health insurance is taken out of your paycheck pre-tax, add those deductions to your after-tax income to determine the income you need to work with for this budget method.

Once you have that number, you split that number into 3 categories: Needs, Wants, and Save/Invest. You put 50% of the determined income into your Needs. You put 30% of your determined income into your Wants. Then, you put the remaining 20% of the determined income into your Save/Invest category.

A big task in this method is going to be determining what is a Need and what is a Want. A Need is required because it is essential or very important, rather than desired. A Want is having the desire or wishing for it; not essential.

Needs 50%

Needs means those things that you HAVE to have to survive and not be homeless. The following are items that go into this category.

- Housing – this is your rent or mortgage payment. If you have a mortgage, this also includes the escrow portion of the payment, whether you escrow with your lender or do it on your own, meaning your home insurance and property taxes.

- Food – this is groceries, NOT eating out/take out/delivery.

- Healthcare/Insurance – health insurance, auto insurance, renters insurance, and life insurance are all necessary unless you can self-insure these items.

- Utilities – Electricity, water, natural gas, wastewater, trash service, etc. What you need to have your home be habitable. You can also include your phone in this category provided that it is needed for your career or equivalent purpose. If you just use it to talk, do social media, and watch YouTube, then it gets moved down to the Wants category. Internet service can also go into this category if it is required for your career or your child’s education. Otherwise, it is a Want and goes into that category.

- Minimum Debt Payments – you need to at least pay the minimum debt payment to avoid the consequences that come from defaulting on any loans, such as a vehicle repossession, being sued, wage garnishment.

Wants 30%

ants encompass those things that do not fall under the Needs category and are not items under Save/Invest. The following items are examples of what goes into this category.

- Clothing – most of you have the basic clothing needed for daily use. This category is for the extra, such as a new dress, those certain shoes, that watch you saw, etc. This type of clothing is not required, thus it is a want.

- Phone – as stated above, if you don’t need your phone for your career, it is a Want.

- Restaurants – basic food is covered under Needs in the form of groceries. Any type of eating not done from the groceries purchased is a Want.

- Entertainment – here would go subscriptions, such as Hulu or Netflix. The Internet would also go here if it is not required by your career, then it is a utility to be covered under the Needs category. Going to events is also here, such as the movies, a dance, the county fair, etc.

- Vacations – we should all go on vacations from time to time. This is still Want though.

Save/Invest 20%

The last category is for Save/Invest. This category is for the following:

- Retirement – IRAs, 401k, 403b, pensions; they all fall here (see 6 Excellent Reasons to Invest for the Long Term),

- Saving up for an item – a new-to-you car would go here (ie. used car); a set of golf clubs; a new computer; items that are wanted, but don’t quite fit into the Wants category. This is typically due to the amount of money needed for their purchase being more than what can be obtained in a single pay period.

- Emergency Fund – eventually you need to have about 3 to 6 months of expenses set aside in an emergency fund. Once the debts are gone you can hit this one hard. For now, though I recommend getting it up to $500 to $2,500, then incrementally adding money to it each month. (see Savings: Why Is It Important?),

- Debt payments above the minimums – this would be where your Snowball or Avalanche payment is. (see 10 Approaches to Pay Off Debts).

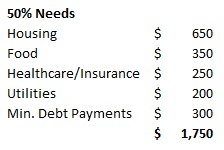

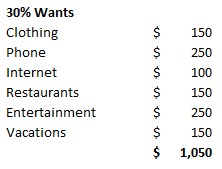

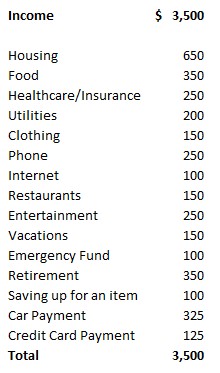

Here is an example of a 50-30-20 budget. In this example, your income is $3,500 each month and your expenses are already known.

50% of your income is $1,750, so your Needs will be allocated like this.

30% of your income is $1,050, so your Wants will be allocated like this.

20% of your income is $700, so your Save/Invest will be allocated like this.

Zero-Based Method

With a Zero-Based budget, you allocate all of your income into your various expenses, savings goals, and debt payments. Your goal is the have zero income left over once you have completed the allocation.

Here’s an example of a Zero-Based budget, using the same income from the previous example.

The Envelope Method (Cash-Only)

The Envelope Method is very similar to the Zero-Based budget. The difference is that you don’t just allocate all the money to the various expenses, savings goals, and debt payments until you reach zero income left, but you also put the money for the various categories into envelopes. Yes, you go to the bank, withdraw cash (or just cash your paycheck if you get an actual check), and put that money into envelopes.

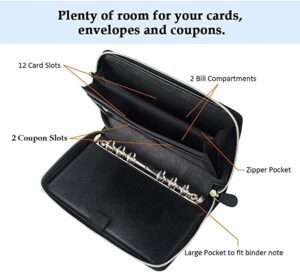

You can use regular mailing envelopes or use one of many envelope systems that you can buy. I use this one I found on Amazon that had everything I needed.

Yes, the Envelope method is what we use in my house and it has made all the difference. Actually, we use a hybrid of the Zero-Based and Envelope budgets. The only envelope we have is the one for Food. In my house both the groceries and restaurants come from here. I do the grocery shopping in my home, as I like to find bargains with coupons. I strive to save money with each trip with coupons. I average about $10 a week saved with coupons. Any money left over at the end of the money stays in the envelope for us to use at restaurants.

We get paid bi-monthly. At each pay period, I withdraw the cash needed for the next two weeks of groceries. Sometimes though a third week will sneak in before the next pay period. For this, I’ve developed a method to have an extra week’s grocery amount on hand. Because I strive to save money at each shopping trip, any money leftover from the week goes towards the “extra” week occurrence. This way when it does appear, we’re covered. I save all the unspent grocery money this way. We use it to buy groceries in between pay periods if we need it, we use it to go out to eat on, and we also use it for special-occasion meals, such as Thanksgiving, which we typically host in our family.

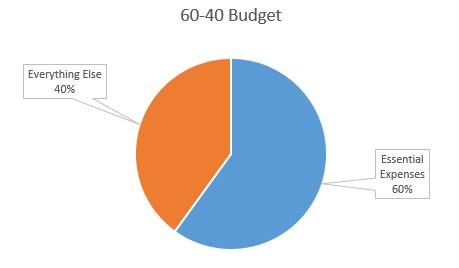

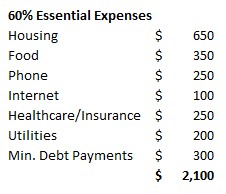

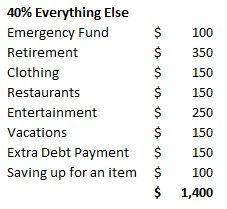

The 60% Method

The 60% Method, also known as the 60-40 Budget, is very similar to the 50-30-20 Method described above. Here though, instead of having two separate categories for Wants and Save/Invest, we combine those. This leaves us with only two categories, Essential Expenses (60%) and Everything Else (40%).

Here’s an example of the 60% Method using the previous examples’ income and categories.

If you’ve never used a budget before, this is the easiest one to set up and follow.

Budgeting Tool

I have recently started using You Need A Budget‘s budgeting tool. It is available on the computer, phone, tablet, any mobile device. I like the convenience to see it from anywhere and it allows my wife and I to be on the same page by always knowing where we stand with regards to our budget and amounts spent. I recommend you try it. You can try it free for 34 days, no credit card is required to sign up. Click here to sign up.

The Plan

In addition to your budget, you need to have a process for knowing what to do with extra money that might randomly come in from time to time. This extra money can be a tax return, a bonus, a stimulus check, whatever. If you don’t have a plan for this extra money it’ll get dwindled away and you’ll have little to nothing to show for it.

My wife and I came up with a process for just such events. We call it The Plan. Original I know.

We first started using The Plan in February 2020. We sat down as discussed the financial goals that we wanted to have covered. These goals were not so far out at retirement and our sons’ college funding, no these were to happen sooner, say in a year or two. We listed out the goals in order of importance. This way when extra money came in we just went down the list and funded them as we could. We are also adding to the list so that we don’t have a place to put extra money.

Here is our list from when we started in February 2020.

- Vacation fund to $10,000

- Adoption fund to $2,000 to cover any fees (we adopted our two new sons last March, so now we have three sons total)

- Christmas fund to $3,000

- Braces fund to $6,000

- A/C repair/replacement fund to $5,000

- Emergency fund to $25,000

As money from tax refunds and stimulus checks, we put the money where it needed to go next. As we completed a goal, we removed it from the list. Also, as our needs changed, we changed the order of the list also. Here’s our list as of April 2021.

- Christmas fund to $3,500

- A/C repair/replacement fund to $5,000

- Emergency fund to $25,000

We have been blessed to be able to complete the steps we did in a timely fashion.

Conclusion

As you can see a Budget is a tool that allows you to have control over your money. You decide where the money goes as it comes in, not circumstance. I recommend that you try different budget methods out. See which one fits your family and your lifestyle. None of these methods are better than the other. The best budget method is the one that you stick to and use successfully month, after month.

Related Topics

See my articles 6 Excellent Reasons to Invest for the Long Term, Savings: Why Is It Important?, and 10 Approaches to Pay Off Debts for more information.

It’s going to be ending of mine day, however before finish I am reading this fantastic article to improve my experience.

Thank you.

Pingback: Auto Insurance: A Deep Dive for Better Understanding - Financially Grounded

Hi there very nice website!! Man .. Beautiful .. Amazing ..

I will bookmark your web site and take the feeds additionally?I am glad to seek out a lot of

useful info here in thhe post, we need develop more techniques on this regard,

thanks for sharing. . . . . .

php patterns

You are most welcome and thank you.

Aw, this was a very nice post. Taking the time and actual

effort to generate a superb article… but what can I say… I put things off a lot and don’t seem to get anything done.

Thank you and very true. We always seem to have tomorrow, until we don’t.

pelisplus Amazing post to find here with this much content. I am surprised to see it really happy.

Thanks so much for your comment. Keep coming back for more content and if you haven’t yet, join my mailing list to get the newsletter, which contains information and tools in addition to what you will find here.

But wanna admit that this is handy, Thanks for taking your time to write this.

In it something is. It is grateful to you for the help in this question. I did not know it. Show more!

Thank you for coming by. I hope to see you again.

Kevin

What’s up to every body, it’s my first visit of this website; this weblog consists

of amazing and really fine stuff for readers.

Thanks. Your comments are very much appreciated.

Kevin