Table of Contents

10 Methods to Pay Off Debt

Debt is a problem that many of us face. Debt not only causes problems for people and families, but it is also one of the largest problems facing our government, from the national level all the way down to the city level. Personal debt is one of the causes of many problems facing our society.

Debt can cause worry, stress, and anxiety. These can lead to serious medical problems. Debt can cause issues with relationships. In fact, fiscal problems are a leading reason for arguments in a marriage. With almost half of all marriages ending in divorce, 30% of those divorces were caused by the stress that fiscal problems bring to the marriage (source).

Finding methods to pay off debt will greatly enhance your health and relationships, not to mention allowing you to hit other financial goals on your journey to being Financially Grounded.

In this article, we will examine 10 different methods to pay off debt. They are:

- Budget

- Garage Sale

- Bonuses, Raises, or Side Hustle

- Avalanche Method

- Snowball Method

- Debt Consolidation (Balance Transfers or Personal Loans)

- Debt Management

- Debt Settlement

- Bankruptcy

- Celebrate Wins and Milestones

1. Budget

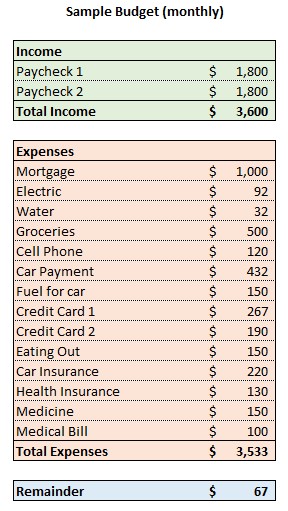

To get started with paying off your debts, you need to first know what you owe and how much the minimum payments are. You will also need to know where your money is going each month. The process used in tracking your money is called budgeting. In a budget, you lay out all of your money: where it is coming from and where it is going to. This is also known as cash flow.

Hopefully, you have enough money coming in to pay all your necessities and your minimum debt payments. Once this is accomplished, we look for extra money to start attacking the debts with. Here is a sample of what a budget would look like. Here you can also see the debts listed in the budget, including their balance, interest rate, and minimum monthly payment.

As we can see from the sample budget, there is an extra $67 each month. We will use this to pay extra on the debts to accelerate our debt payoff schedule.

To be successful with the debt payoff schedule, you need to be able to pay more than the minimum payment each month. If you only pay the minimum, you will be trapped by the debt. According to MarketWatch, a $2,000 credit balance with an 18% interest rate and a $10 minimum payment, would take 370 months to pay off. This is over 30 years, longer than a mortgage. Not only would it take a very long time, but you would end up paying more than $4,931 in charges and interest. This is more than double the initial debt amount. This is an extreme example, but you get the point.

This same debt with that extra $67 added to the $10 would pay off in 34 months (or just under 3 years) and you end up paying $554 in charges and interest. This way saves you 27 years and $4,377.

Now that we have our budget, let’s look around to see when we can find extra money. Your budget may not have any wiggle room, thus no extra money each month. If this is the case, you will need to create an infusion of cash to give you the push needed to get the debt payoff schedule going.

2. Garage Sale

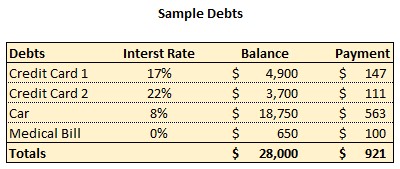

A garage sale is a great way to get the money needed to kick off the debt payoff schedule. If you didn’t have the $67 per month extra in your budget, you will need to be able to pay off one of the debts you have in very short order to create the needed wiggle room. In the sample debts above you see that the medical bill has a balance of $650. With a big enough garage sale, you can raise that much money. Once that debt is paid off, you then have the extra payment money you need to get your debt payoff schedule underway.

In addition to giving you the immediate infusion of extra money you needed, having garage sales on a regular basis can provide extra money to throw at the debts as you go along. We have a family member that gathers unwanted items from friends and family members whenever she can. Once she has enough, she has a garage sale to get an extra income stream. By letting her friends and family know she’s doing this, they, in turn, set things aside for her.

3. Bonuses, Raises, or Side Hustle

Some of us have jobs that pay bonuses, usually upon completing a goal of some sort or at the end of the year depending on company profits. This extra money can be used to throw at the debts to get them paid off sooner, rather than later.

Raises can also be used for this. Even if you only get a cost of living increase each year, apply that extra take-home money towards your debt payment to pay off the debts even faster. You’ll see shortly that every little bit helps to move the needle.

If you don’t receive bonuses and raises are few and far between, consider starting up a side hustle to get additional money. Like my family member in the section on garage sales, you can do a periodic garage sale to bring in extra money. Look at what your skills are and see what you need to do to monetize them. Even mowing lawns on weekends can add another $50 dollars income to go towards paying the debts off.

Look online for side hustle opportunities based on your own skills to see how to market yourself and make additional money.

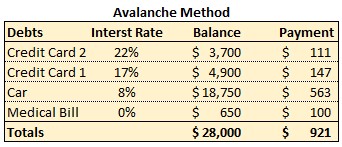

4. Avalanche Method

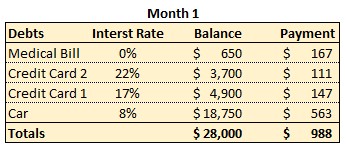

The avalanche method is set up to pay off the debts quickly while paying the least amount of interest and fees throughout the process. List your debts out, highest interest rate to lowest interest rate, regardless of balance. Using the sample debts above your debt avalanche will look like this:

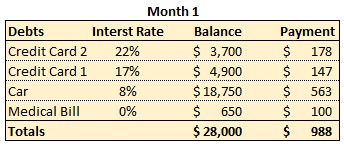

The payment listed by each debt is the minimum payment required each month. If you can gather any extra money, such as the $67 remaining from the sample budget above, add that to the payment of the first debt on the list, Credit Card 2. Your new monthly payment goes from $111 to $178.

Each month you pay the monthly payment amounts indicated in “Month 1” until a debt has been completely paid off.

Once a debt is paid off, take that debt’s monthly payment and add it to the next debt on the list. In this example, you see that the Medical Bill debt is paid off due to its low balance. Take the $100 monthly payment and add that to the highest interest debt, Credit Card 2.

Keep paying each month. As you pay off the next debts on the list, add the amount of money you were paying on them to the next debt on the list. As you pay off the debts, your monthly payment grows and grows. By the time the Car is the only debt left, your monthly payment will be at least $988, provided you don’t add extra money to the payment, such as bonuses, raises, side hustle, garage sales, etc.

You will completely pay off the debts listed in 34 months, having paid a total of $4,429 in interest and fees during that time.

5. Snowball Method

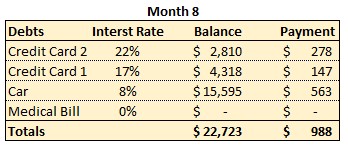

The snowball method is set up to pay off the debts quickly while paying the least amount of interest and fees throughout the process. List your debts out, lowest balance to highest balance, regardless of interest rate. Using the sample debts above your debt snowball will look like this:

The payment listed by each debt is the minimum payment required each month. If you can gather any extra money, such as the $67 remaining from the sample budget above, add that to the payment of the first debt on the list, Medical Bill. Your new monthly payment goes from $100 to $167.

Each month you pay the monthly payment amounts indicated in “Month 1” until a debt has been completely paid off.

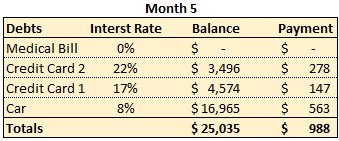

Once a debt is paid off (the Medical Bill), take that debt’s monthly payment and add it to the next debt on the list. Take the $167 monthly payment and add that to the next debt, Credit Card 2. The new payment for Credit Card 2 is $278.

Keep paying each month. As you pay off the next debts on the list, add the amount of money you were paying on them to the next debt on the list. As you pay off the debts, your monthly payment grows and grows. By the time the Car is the only debt left, your monthly payment will be at least $988, provided you don’t add extra money to the payment, such as bonuses, raises, side hustle, garage sales, etc.

You will completely pay off the debts listed in 34 months, having paid a total of $4,453 in interest and fees during that time.

So, why would you choose one method over the other? In our example, they both paid off at the same time, and you saved $24 in interest and fees. Logic says that the avalanche method is the better method to use. This is true, but it is easier to stick with a debt payoff method that will take almost 3 years to complete it you can see traction.

With the snowball method, you will completely pay off your first debt at Month 5. With the avalanche method, you will completely pay off your first debt at Month 8. That 3-month difference can be an enormous psychological boost in your confidence to complete the debt payoff plan.

Remember, being Financially Grounded is about personal finance. The word personal is very powerful. As with all things in personal finance, it has to do with changing behavior and your way of thinking about money. Your emotions are very much tied in with your personal finance. Having the hope that this can be accomplished will go a long way to keeping you on the course to being Financially Grounded.

6. Debt Consolidation

Debt consolidation can come in a couple of forms. One is through balance transfers and the other is using personal loans. Let’s go through each using the debts shown above.

A personal loan is one that is taken out by you from a lending institution, such as your bank or credit union. There is no collateral to secure the loan against, so the interest rate will typically be higher than that of a mortgage or car loan. Still, the interest rate should be lower than your credit cards. Not only are you consolidating all of the debt under a single loan and lowering your overall interest rate, but you are also going from multiple payments to one.

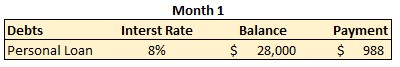

Using the debts shown above, you would consolidate all of the debts into a personal loan for $28,000. We’ll use an interest rate of 8% for this example. Yours may be higher or lower depending on a number of factors.

We will continue to pay the total monthly payment of the avalanche and snowball methods for $988 ($921 minimum payments + $67 remainder from the budget). The minimum required payment is $560. With the payment of $988, you are paying an additional $428 straight to the loan balance principal each month.

You will completely pay off the loan in 33 months, having paid a total of $3,113 in interest and fees during that time.

Sounds great, right? Why bother with the other methods? Well, you may not qualify for a personal loan, or if you do, the interest rate may be too high to justify it. If you qualify for a personal loan, but your interest rate is 11% or higher, the numbers don’t work in your favor. With an 11% interest rate, it will take 34 months to pay off the loan and during that time you will have paid $4,571 in interest and fees. Better to use the avalanche or snowball method.

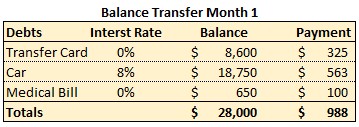

In addition to personal loans, performing a balance transfer is another option for paying off debt and saving on interest payments. If you have high-interest credit card debts, you may benefit by moving those balances to another card(s) that offers a balance transfer. Balance transfer offers typically charge 0% interest for the offer period, which is usually between 6 to 18 months. In order to avoid paying additional fees or being charged interest, the entire balance that is transferred over must be paid in full before the offer period ends.

If the offer period expires with any balance due or you make any late payments, you will automatically be charged the going rate for that card, which can be as high as 29%.

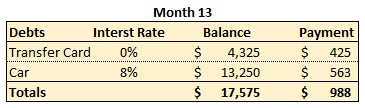

Using the debts above, let’s say we combine both credit cards onto a balance transfer offer for 12 months at 0% interest. After the 12 month offer period, the interest rate increases to 29%. Given the combined minimum payment plus the remainder from the budget, the monthly payment would be $325 and the balance would be $8,600. After 12 months you will still have an unpaid balance of $4,325. You would now be charged 29% interest on this balance.

Continuing the debt repayment plan, you will completely pay off the two credit cards after 23 months. This is 5 months earlier than either the avalanche or snowball method. The remainder of the debt, the Car, would then be paid off at Month 32. The total amount of interest paid over the entire length of the plan would be $2,971.

Faster and costs less, sound perfect, no? The major pitfall with all of these plans is that you don’t change the behavior that got you in debt in the first place. With both of these methods, you have two completely empty credit cards, just calling to be charged on. You could very easily end up with more debt than you started with and be in a worse position. That more than anything needs to be examined before you choose a debt payoff method.

7. Debt Management

The debt management method is very similar to the personal loan method. In debt management, only unsecured debt such as credit cards, personal loans, and medical bills are covered. Secured debt such as houses and cars does not qualify for the program.

You will need to use an accredited nonprofit from the National Foundation for Credit Counseling. The counselor will investigate all of your financial situation, not just the debts to determine the best option you have available.

Once you’ve selected a credit counseling agency, the counselor will contact your creditors to let them know you are now on a debt management plan and to set up your account so that the creditors will accept payment from them. The counselor negotiates with your creditors to get the interest rate lowered, thus lowering the monthly payment due. They may even be able to remove all late fees due.

During your time using the debt management method, you will not be able to use credit cards at all. Any attempt to open a new credit card could void out your contract with the counselor and cause them to remove all concessions made.

8. Debt Settlement

The debt settlement method can be performed by you directly or by using the service of a third-party company. In a debt settlement, the creditor agrees to accept a lump-sum payment in an amount less than the full amount owed. The creditor does this because they feel based on your previous actions that they won’t ever collect on the full amount and something is better than nothing.

If you take on this on your own, here is how it would proceed. By now you have either stopped making payments on your debt or have not been able to make the minimum payment for some time. You will then call up the creditor and let them know that you would like to offer them a lump-sum payment to settle the debt in full. Your creditor will not agree to this on the first call. It will take many calls and the creditor may become abusive during the calls during this process. Do not call your creditor up and offer them a lump sum unless you have that money in hand at that time.

Once they accept the debt settlement, ask for the agreement in writing. Only when you receive it in writing do you send the creditor a cashier’s check for the agreed-upon lump sum payment. Do not give the creditor access to your bank account to draft the payment. They will likely take more than what is agreed upon and then you will have to fight with them to get your money back.

As Dave Ramsey, a well-known financial guru is fond of saying, “you know a debt collector is lying if his mouth is moving.”

When you hire a debt settlement service, they typically advise you to stop making payments to your creditors and instead pay them. The money you pay to the debt settlement service will then take that money and put it into an account. Once the balance of the account reaches a certain level they contact your creditors and try to negotiate the lump-sum payment on your behalf. The amount that this service will cost you can range from a percentage of the amount you ended up settling the debt for up to a percentage of the total debt amount. This percentage can range from 15% to 25%, depending on the debt settlement service company.

The benefits of using the debt settlement method are as follows.

- You lower the debt amount owed.

- It is better than filing for bankruptcy.

- It may give you some breathing room between you and your creditors.

There are many risks to this method though.

- Your creditors may not negotiate.

- As a result of you stopping payments, many fees and penalties will accumulate, adding to the total amount owed.

- It will negatively impact your credit, due to the late payments and the failure to pay.

- The creditor can sue you for non-payment. If they do they will win. You owed the debt and failed to pay. End of story. The creditor will then either garnish your wages or put a lien against your property.

- The forgiven debt is taxable as income to the IRS. You may owe taxes the following year on the amount forgiven.

9. Bankruptcy

If you have tried all of the above methods to paying off your debt and are still having troubles, then you have the option of filing for bankruptcy. Please know that due to the effects that bankruptcy will have on your life and credit, it should be considered as a last resort. I would even put it in the same boat with divorce.

There are two different types of bankruptcy that you can file. There is a Chapter 7 and a Chapter 13. Each of them works very differently from the other. Let’s go over each one.

A Chapter 7 bankruptcy is what most people think of when they think of bankruptcy. The filing is quick and you are not required to pay back any debt. To qualify for a Chapter 7 bankruptcy you must have a gross income that is less than your state’s median income. You must not have had any bankruptcy discharged in six to eight years, depending on the type of bankruptcy previously filed. There is also a length of residency required for filing in some states.

A Chapter 7 bankruptcy takes about four to six months to complete. Once Chapter 7 is filed it will halt any evictions, foreclosures, or repossessions, at least temporarily. Chapter 7 is used to wipe out unsecured debt such as unsecured credit card debt, medical bills, personal loans, and past-due utility bills. Secured debt can also be wiped out with a Chapter 7, but you will be forced to give up the property, such as a car or a house.

A Chapter 7 will remain on your credit bureau reports for ten years after the filing date. You also will not be permitted to file another Chapter 7 for eight years.

A Chapter 13 bankruptcy is different in the sense that you get to keep your property in exchange for partially or completely repaying the debts. With Chapter 13, the bankruptcy court works out a payment plan to pay your creditors over the course of three to five years. You must adhere to the court-ordered payment plan in order to keep your property. Failing to do so will cause the property to be repossessed.

A Chapter 13 will remain on your credit bureau reports for seven years. You will not be permitted to file another Chapter 13 for two years.

For both types of bankruptcy, you will be required to complete credit counseling.

Not all debts can be discharged with a bankruptcy filing. Here is a list of debts that cannot be discharged.

- Alimony and/or Child Support.

- Certain taxes, such as liens. Also, most federal, state, and local taxes unless they are several years old. Check with a bankruptcy attorney on this item.

- Debts for malicious and willful injury to another person or property.

- Debts for injury or death caused by the debtor’s operation of a motor vehicle while under the influence of alcohol or other substances.

- Student loans are very difficult to discharge unless you meet hardship qualifications. Check with a bankruptcy attorney on this item.

- Debts you fail to list in your bankruptcy filing.

10. Celebrate Wins and Milestones

As you work through these various methods to pay off debts you will be hitting milestones. You need to set milestones for yourself to celebrate your progress and wins. The milestones can be small, such as paying off the first debt or paying off $1,000. Whatever you set for yourself be sure to recognize them, the effort that went into achieving them, and feel good about accomplishing them.

Regarding the celebration, keep that part reasonable. Don’t go out and blow $500 to celebrate paying off $1,000. This would be two steps forward and one step back, big time. Your celebration should be no more than the portion of your debt that the milestone represented. Using our debts from above, the total of $28,000, and the $1,000 pay-off milestone, set a 10th of the goal as the max to spend on the celebration/reward. That’s $100. That’s a nice dinner out, a date night, an evening out with friends, or a message for you. And remember, be sure to pay cash for the celebration. You just paid off debt, don’t add it back to the pile now.

Conclusion

Debt can rob us of many things such as our health, our happiness, and our relationships. Know that you aren’t alone in your journey to being Financially Grounded and that there are a lot of resources you can use for support in the methods to pay off debts. If you need extra guidance or answers to personalized circumstances, leave a comment below so that I and this community can help you.

I personally believe that debt is cancer in our society. Yes, there are good uses for debt, such as buying a house or other large items, but we put everything on credit: milk, beer, candy, groceries, bills, and up from here. A large part of being Financially Grounded means to have control of your money, not the other way around. Debt controls you, either a little or a lot. At its extreme, you have to choose between eating and paying your debt payments. No one deserves to live like that and I for one am going to do what I can to help.

Related Topic

See my articles on What You Need to Know About Debt and 7+ Forms of Income You Need to Know for additional information.

Pingback: Improve Cash Flow With Budgeting and The Plan - Financially Grounded

Good day! This is kind of off topic but I need some advice from an established blog. Is it very hard to set up your own blog? I’m not very techincal but I can figure things out pretty fast. I’m thinking about setting up my own but I’m not sure where to begin. Do you have any ideas or suggestions? With thanks